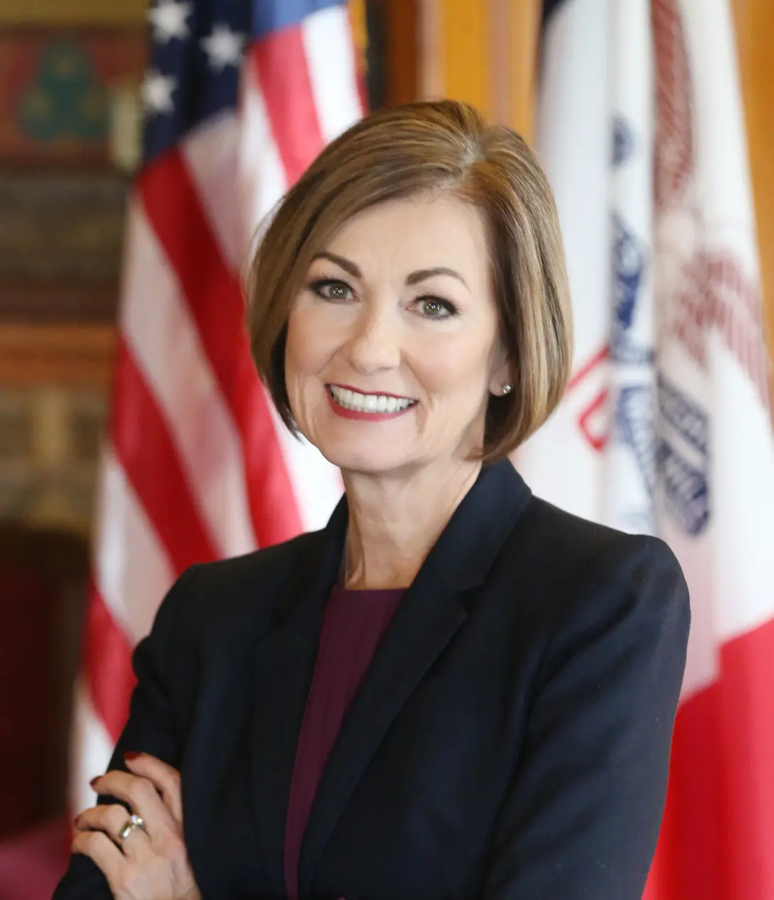

DES MOINES—Today, Governor Kim Reynolds enacted SF 607, legislation aimed at reducing the unemployment insurance taxable wage base and lowering the maximum unemployment insurance tax rate.

“Iowans are successfully securing new jobs in an average of just nine weeks. Consequently, our unemployment trust fund is at a healthy level,” stated Gov. Reynolds. “With a fund balance nearing $2 billion, we rank ninth highest in the nation, despite being 32nd in population. This new law will cut unemployment insurance contributions for employers by 50%, leading to almost $1 billion in savings for businesses of all sizes and enabling them to reinvest in their employees and local communities.”

SF 607 reduces the unemployment insurance taxable wage base by 50%. Furthermore, it streamlines the unemployment tax tables and decreases the highest tax rate from 9% to 5.4%.

The provisions of this legislation will take effect on July 1, 2025.